Retirement Advice in the Modern Age of Automation

Everyone thinks about retirement, but how many of us actually do anything about it? Research actually shows that less than half of young adults and only about 52 percent of those over 55 are actively saving for retirement. I can guarantee that none of those people want to have to work for the rest of their lives.

There are some that simply have not made a plan to start saving. Others feel they do not have enough money. Some people just do not know where to start. Then, there are those that do not understand all of the digital tools around to help with retirement, so they avoid them.

Retirement Advice When Using Automation

In this article, our retirement advice dives a little into the automation concern, how automation can benefit you financially, and how to use it efficiently.

Retirement Starts with Good Financial Management

In a few moments, we are going to get into automation and how to use it, but there are a few bases to cover before we do. I know that some people think that robots are going to take over the world and all, and I am not here to argue with anyone’s beliefs. What I can say is that at this point, humans are still in charge. Computers and AI do what we tell them and train them to do. There is a human brain behind all of this.

What does this mean for you? Well, it’s like this: There is no automation in this world that is going to work for you if you do not tell it what to do. Your banking app does not know to transfer $20 to your savings account every Friday unless you tell it to. Your check does not even go into your checking account without someone telling it where to go.

To simplify all of this here is some retirement advice in the midst of all the available automation: Successful automation and planning for retirement must begin with good human financial management, which includes:

- Paying bills on time

- Cutting unnecessary expenses

- Spending carefully

- Paying off debt

- Living within- preferably below- one’s means

- Setting and working toward financial goals

- Saving for retirement

- Carefully considering all financial moves

Planning for Retirement

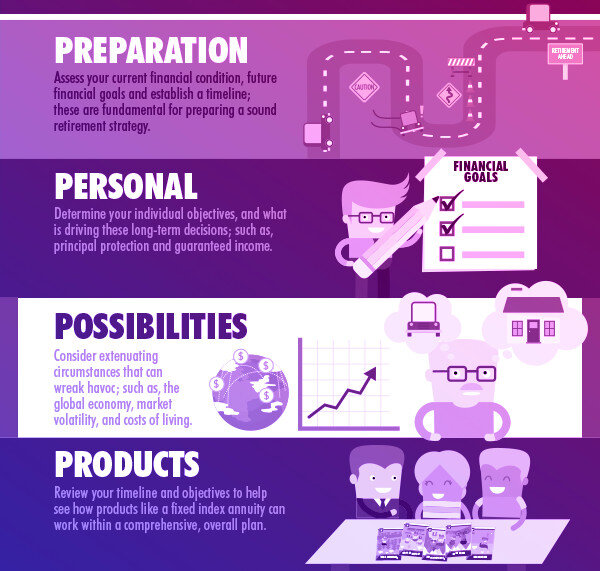

We are here today to talk about retirement advice and how automation fits in. I know many people avoid planning for retirement because it seems complicated, but the basic steps are really simple.

- Determine Your Retirement Goals

What do you want to do when you retire? How much money will that require? How much will you need to live off of?

- Choose Financial Tools to Meet Those Goals

These tools are the actual places where you will put your retirement savings, such as a 401k.

- Determine the Steps and Systems You Need to Take

How much do you need to put away each month or week to save enough for retirement? Where will that come from (paycheck, a gift from a relative)? Automatic or manual transactions?

- Monitor Your Progress and Revise as Needed

.

Check-in regularly to be sure you are on track

Get Started

The best retirement advice you are ever going to get is this: get started preparing for it. Regardless of how old or young you are, where you live, how many hours a week you work, or anything else, you need to prepare for retirement. Sure, maybe you should have started ten or twenty years ago, but there is no reason to wallow in regret. You cannot turn back time, but you can start right where you are now.

Retirement Account Types

There are plenty of ways to save for retirement, and it is very wise retirement advice to choose more than one option. Spreading your retirement savings out over a few different methods is the best way to go. Take a look at the following options and choose a few for a deeper look.

IRAs or 401ks

IRA stands for “Individual Retirement Account” and is a retirement account opened by an individual. A 401k is a retirement account that is typically provided by an employer. And to be truthful, there are many types of these accounts. It is often helpful to speak to a financial advisor so that they can help you choose which one might be best for you.

Savings Account

I said that wise retirement advice is that you should have your retirement savings in multiple accounts. One of the accounts you should use is a traditional savings account. With these accounts, your money may not earn a ton of interest, but you can rest assured that your money is safe.

A few years back, I received some retirement advice on spreading out my money. I was told that while it’s okay to be risky with some of your money for the sake of higher earnings, it is important to be sure you also play it safe with a good portion of it. Money in a savings account is safe unless you withdraw it. Your money is insured by the FDIC, so you do not have to worry about the bank losing it. It will be there when you want it. As a matter of fact, if you don’t already have a savings account, you should open one right now. This was one of the best steps I took when I wanted to get my finances in order. Here are some of our suggestions:

Mutual Funds

Mutual funds are also a good way to save for retirement. They are a bit less risky than investing in individual stocks because your money is spread among several investments. And they do not take as much as many stocks to invest in.

Stocks

If you are ready to go for some risky business, the stock market might be your jam. Now, let me say upfront that investing in the stock market is not necessarily a bad thing. In fact, plenty of people have made good money on stock. However, many people have also lost a lot of money. This is why you should spread your retirement savings out among many things. You do not want to invest it all in the stock market and end up losing it all. Never, ever invest more than you can afford to lose.

CDs

CDs are a safe way to invest, as they are also insured by the FDIC like savings accounts. They have higher interest rates than savings accounts, too. The biggest downside is that you are committed to leaving your money in a CD for a set period of time, typically one to five years.

Bonds

Bonds are similar to CDs, except that bonds are issued by companies or the government where CDs are issued through banks. You also have to leave your money in longer, usually ten years or more.

You can set up automation to deal with most of these accounts, but you first need to determine which types of investments to make. You might choose to send a portion of every check to your savings, a mutual fund, an IRA, and stock. If you want to find a great mix for funding your retirement goals, it is always a good idea to consult a financial advisor for individual retirement advice.

The Convenience of Automation

Automation really is an awesome thing to have. I mean, it’s almost like having an assistant, which I have always said I need. Who can’t use an extra set of hands or someone making moves that need to be made? I am a fan of anything that can simplify my life and open up time for other priorities in my life. I would much rather be playing with my kids than paying bills.

Automation may be scary and intimidating for some, but it really can be an incredible asset. You can use it to pay bills, save, invest, reorder household items, set up appointments, and more. Yes, it takes a little time to set up the commands, but once you do, it can save you hours every month.

Benefits of Automation

Simplifies Redundant and Tedious Processes

Did you know that you can set up your email to automatically delete some emails and file others? Or have you heard of an app called IFTTT? It stands for “If This, Then That”, and you set it up to complete certain tasks if a particular action occurs. For instance, you can set it to respond a certain way to particular emails, or to put a certain amount in your savings account every time money drops into your checking account- even if it is not payday. And, of course, you can set up automation with saving and investing from your paycheck and to pay bills.

Easy to Use

Believe it or not, automation is easy to use. It may take a little time to get comfortable with it, but it is actually pretty simple.

A Shop to Build Your Wealth

Step up Your Financal Game

Saves a Ton of Time and Even Money

We already talked about how automation can save you time through redundant tasks. We also talked a little about how you can automatically grow your savings through automation, but there are actually a few other ways that it can help.

Think about this: How often do you end up paying late fees on your library books or bills? Or how often do you miss big sales or birthdays not because you do not know the date but because you do not realize that the date has come? You can easily set up your systems to send out reminders for everything, meaning if you forget to look at your calendar, that’s okay.

These reminders can be set to go off a week or a few days before or on that particular date. You can even set up systems to automatically send a “Happy Birthday” message- months in advance. Everything I have mentioned so far is on a personal note, but there are plenty of uses for automation in business as well.

Downsides to Automation

Time to Set Up

I said above that it does take some time to set up automation systems. The amount of time really depends on you, the system you are using, and what you are using it for. Still, it can produce a major payoff, so take some time to consider it.

Lack of Attention

One of the biggest problems with automation is that users may actually stop paying attention to things. For instance, you might choose to set your electric bill up on auto-pay. Every month, the electric company charges your debit or credit card for the amount of your bill.

Yes, it can be freeing to let go of the tedious task of bill paying, but it can also cost you a lot of money. Let’s say you stop paying attention and your electric bill increases 10 percent every month. If you know it is increasing, you can take steps to lower your power consumption. If you do not realize it’s increasing, you may end up paying out hundreds or thousands more each year than you expected to.

And what about your savings account or retirement accounts? What if interest rates change and suddenly you are not earning as much as you thought you were? Or what if money from your savings is having to be transferred to your checking account to cover that higher electric bill? Do you see how this could negatively impact your life?

So, let’s go into a bit more detail regarding the retirement advice and how to get the most out of automation.

Vigilance is Key

Understand that while automation lets you “set it and forget it”, that does not give you an excuse to forget it for good. Automation is meant to free up your time and simplify life, but it will do neither in the long run if you just let it do its own thing continually. You have to actually keep an eye on things. About once a month, you need to check in with the following:

Your Bills

Take a look at each of your bills, especially those that are set up on auto-pay. Make sure the balances have not changed, that you still need the service or product and that they have a good payment method and contact info.

Your Goals

Are your financial goals the same? Has anything changed with them? Have you made any progress toward them or do you need to reevaluate your game plan?

Your Savings

Is your savings growing? Do you need to transfer more on payday than you are right now? Is the interest on your savings within the same range as other savings accounts or should you consider switching banks? Is there anything about your savings plan you need to tweak?

Your Investments

How are your investments doing? If you have any retirement accounts, are they on track for your retirement goal? Are you earning a good interest rate? Should you revise your investment plan or move your investments elsewhere?

Your Budget

Life changes and budgets have to change with it. It is dangerous to automatically assume that the budget you made six months ago is still valid now. It may be but you need to make sure.

After doing your monthly check-in, which you can set up an automatic reminder for, take a look at your budget. Make any necessary changes to get your retirement accounts or other savings goals on track.

Set Up an “Overwatch” Program

While you do need to keep an eye on things, there are certain services you can sign up for- for free- that help. For instance, I use an app called Trim. It notifies me if there are any changes in certain accounts, and it even negotiates lower rates on some of my bills for me. Look into Trim or a similar service that can help you keep an eye on your accounts.

Know That Automation Is Not an Excuse for Lack of Knowledge

I already made the point that humans are behind automation, but this is really important to note. If you do not know how to handle money efficiently, you will not be able to set up efficient automation. You need to know how to manage money well, so educate yourself in any areas you are not confident about. Then, set up your automation.

Use It to Your Advantage

The world has gone digital and guess what? There is no sign of that changing. The best thing you can do, the best retirement advice I can give you in the age of automation, is that you should learn to use it to your advantage.

Question: How many of you have a robot vacuum? How many of you want one? I know I do. It takes a lot of time to keep a floor clean. Why not let one of those awesome devices handle that task for you?

Using automation for your finances is really no different. It is a tool, no different from a hammer or a chainsaw. They can all be used for their purposes and produce great results.

Conclusion

If your financial institution offers any type of automation, give it some real consideration. The humans behind the institution are there to teach you how to use it if you ask. This is also very useful when thinking about retirement. Do be sure, though, to keep an eye on everything as I said above and follow the retirement advice I suggested. Otherwise, you might find yourself in a financial mess down the road.