Savings

We all know we should do it. Many of us try here and there, although fewer than half of us have a specific plan that we follow. And tucked somewhere in the American psyche is the unspoken idea that we’d have more savings – we’d pay more attention to saving plans and set up the best savings account and make the most responsible long-term choices – if only… well, if only something.

If only we made more money. If only we could get past these medical bills. If only things didn’t keep happening to make it harder. If only we could get our kids through school. If only the economy would improve. If only things outside of our control would change enough that we could do our part. Then we’d save. Then we’d get serious about an emergency fund, and investing for retirement, and figuring out what a compound interest savings account is. For sure. If only.

We get it. It can seem so daunting to even think seriously about my savings (or lack thereof), let alone discuss different types of savings plans or current savings interest rates or – seriously, an emergency fund? It feels like every dollar I manage to bring home is already the emergency fund! Please know that nothing we suggest here is about criticizing or correcting you or anyone else. It’s not about scaring you into following a program or purchasing a service or agreeing to a system.

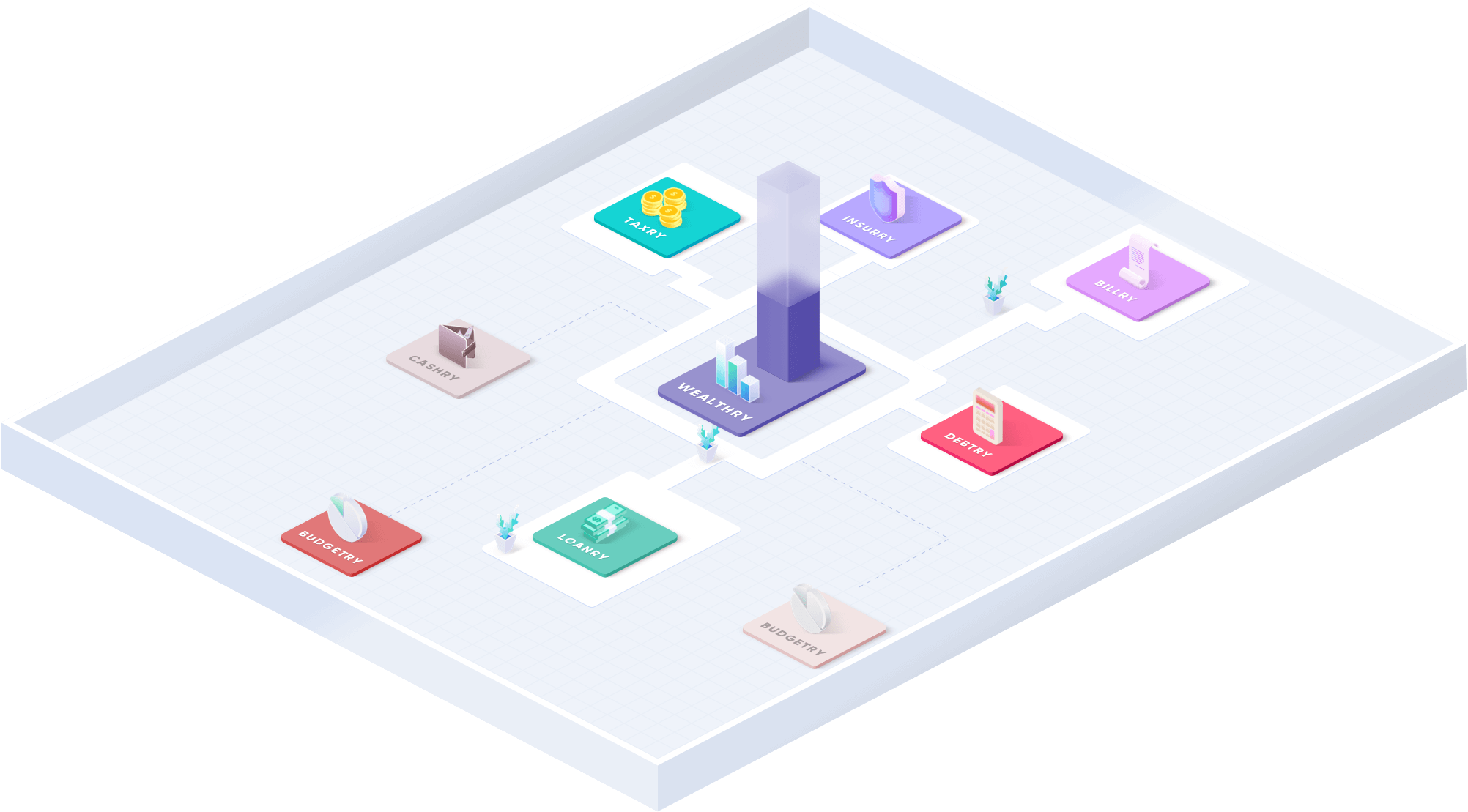

We have a guiding philosophy here at Wealthry, and across the Goalry family, that most people are perfectly capable of taking more effective control of their personal and small business finances if provided with the right information in easily accessible language, the right connections and tools to make sense of their own finances, and opportunities to move forward instead of just wishing they could.

None of us need one more thing to feel like we’re not doing right. Most of us are doing the best we can with what we’ve been given – often far better than anyone has a right to expect. It’s in that spirit that we’d like to offer a few basic thoughts on savings and their potential value to you – not as one more thing to worry about, but as one more way to take better control of your financial world. As we’ve all recognized by now, better control of our financial world usually means a smoother ride with everything else.

No sense saving it for the end. Let’s just play our hit single first and go from there. We present to you, the BEST SAVING PLAN EVER, free of charge to read as often as you like and apply as you see fit:

Thank you, and goodnight! Don’t forget to buy a t-shirt on your way out.

Now, we’re glad to talk about savings account interest rates and compare money market accounts and explain CD savings and how they work. Our blogs are filled with tips on how to effectively negotiate bills and pay off debt quickly and plan for retirement. We can lay out average savings by age in the U.S. or around the world if you’d like to see how you’re doing compared to everyone else. There’s value in talking about the best ways to save and what we can do to simplify the process. But it all starts with a commitment to save something, and to start now – in your financial situation, in your life, in your household, with your current income, in this economy. Save more if you can, but save something – regularly and repeatedly – just to get the principle established. You can tweak the specifics as you go.

Almost any financial institution offers some form of savings account. A savings account is any setup by which you regularly deposit money you don’t intend to spend anytime soon. Sometimes they’re used to save up for something specific. Other times they’re intended as an emergency fund – resources to tap for unexpected repairs or medical expenses or legal fees or other complications. Unlike credit cards or personal loans, your savings account pays you interest rather than you paying interest for using it.

Setting up a savings account is fairly straightforward. You’ll need ID, your date of birth, social security number, and proof of your address. Your standard savings account rates are fairly modest. In recent years, it takes some comparison shopping to even top 1%. Savings accounts are extremely secure, however, and insured by the FDIC for up to $250,000.

Before committing to even a basic savings account, however, there are a few things you’ll want to clarify. Is there a minimum deposit to get started? Are there penalties for falling below a minimum balance in the account? For making too many withdrawals or too few deposits? Is there a monthly service charge to maintain the account? Even modest fees can add up quickly and offset whatever interest you’re earning. There are too many free or nearly free options for you to take the first thing that comes along. Compare savings accounts just like you would anything else.

There’s no single answer to this, and if there were, it could still change by the time you read this. If you’re looking for specific information on interest rates and financial institutions, check out the Wealthry blogs and some of our links to real-time information. We’ll point you to the best rates, best features, and best comparison points. In general, however, you have three basic options for setting up a savings account – traditional banks, credit unions, and direct banks (“virtual” or “online only” banks).

Traditional banks have been around forever. They tend to offer the widest range of financial services and have the most branches and ATMs and conveniences. Banks are for-profit institutions, however, meaning they’re in business to make money. There’s nothing wrong with that, but it’s worth keeping in mind as you compare bank interest rates looking for high interest savings options.

Credit unions are not-for profit institutions formed to serve a specific population – local educators, military families, employees of a specific company, etc. You can only do business with a credit union if you’re a member, which used to require belonging to the particular group it was formed to serve This may still be true in some cases, but these days joining a credit union isn’t usually much different than using a local bank. Credit unions may offer fewer services than traditional banks, but they generally offer the things most of us would expect, often on better terms because of their not-for-profit structure. You’re unlikely to find a particularly high yield savings account no matter where you go, but often the savings rates, CD rates, and other options available through credit unions offer better returns than traditional banks.

Finally, it’s quite easy these days to open savings account online. Direct banks (the “online only” sort) don’t have the overhead of your local bank or credit union and don’t have to maintain those nice lobbies or make popcorn while you wait. (To be fair, they don’t sponsor the local little league team, either.) Some offer a full range of financial services like a traditional bank while others specialize in specific services like personal loans for bad credit or refinancing your mortgage. This means that direct banks are often able to offer the best online savings rates and the top savings accounts options. They’re a large part of why your local bank or credit union is working so much harder these days to remain competitive. Thanks, healthy American competition!

Most brick-and-mortar banks have an online presence these days as well. Very often, you can do almost all of your banking online without ever going to a physical bank.

Anything approaching high yield savings account rates won’t come from your basic savings accounts. Generally speaking, the lower the risk, the lower the reward. Think about gambling. When you pull that slot machine arm or buy that scratch off ticket, it’s almost certain that you’re going to lose your investment. You play because if you win, it could be huge! Usually, of course, you’re going to lose. That’s how the system is set up.

Investing in the stock market isn’t necessarily as risky as actual gambling, but the principle is the same – the higher the risk, the higher the potential payoffs and the potential losses. Anything you find that offers better returns than the highest savings account rates currently available probably comes with increased risk as well. That doesn’t make it a bad idea, but just like with gambling, don’t bet anything you can’t afford to lose.

Here are a few relatively low-risk ways to secure better returns on our savings…

If you’ve ever given or received savings bonds, you already know how CDs work. CDs are a form of low-risk savings in which you agree to deposit a specific amount of money for a preset amount of time (usually three to five years, although some are shorter or longer). When that time is up, you can redeem the CD for your original investment plus interest. Some investors will stagger their CD savings redemption dates so they don’t all mature at the same time. This is called “laddering” and it allows you to (a) access money when you need it without the penalties of early withdrawal, and (b) retain some flexibility regarding other savings or investment options with the funds.

CDs are issued by banks or credit unions, while bonds are issued by companies or the government. They’re otherwise very similar, although if you’re considering a substantial investment in one or the other, you should read up on the details in the Wealthry blogs first. CDs are considered “savings” in terms of FDIC coverage, and while cd rates aren’t always phenomenal, they tend to be higher than basic savings while making it less tempting to dip into them for impulse purchases.

These are essentially a hybrid between your typical checking account and a standard savings account. You deposit funds like you would with a savings account, but money market rates are historically higher than basic savings rates (although that hasn’t always been the case recently). You’re allowed a limited number of transactions of the sort you’d have with a basic checking account – withdrawals, writing checks, utilizing a debit card – but the goal is saving money, so these transactions are limited.

Recent money market rates aren’t noticeably higher than traditional savings account rates. If you’re considering this option, make sure to compare money market accounts from several different institutions as well as comparing money market rates to standard savings rates at the same institutions. If they’re the same, these may not be the best saving plan for your circumstances.

This system is not nearly as bizarre as its name suggests. The idea behind robo-savings (sometimes called “micro-savings”) is to automate the process so you’re more likely to accumulate savings over time without feeling like you have less money to spend. It’s essentially an automatic change jar for your electronic transactions. The most common form of robo- or micro-savings looks like this:

Let’s say you decide to open savings account online as an emergency fund. You find the closest thing to a secure, high interest savings account you can, then link your credit card or debit card to the account through the micro-savings (“robo”) application using your laptop, phone, or other securely connected device. Each time you make a purchase, the application rounds up the amount to the nearest dollar and deposits the difference into your savings. You buy coffee for $1.29, it pulls 71 cents from checking or your credit card and drops it into your online emergency fund. You charge a vehicle repair for $345.62, it puts that extra 38 cents in your account.

Over time, you’ll discover you have several hundred dollars saved, then several thousand, all without every paying much attention to the dimes and quarters being set aside on your behalf. Now the micro-investing option kicks in.

Depending on what you’ve chosen ahead of time, once your account hits a certain level - $5, $50, $500, or whatever you choose – the app begins investing that money according to guidelines you’ve set. You can choose from stocks, bonds, real estate, or some combination of the three. Different apps offer different levels of control. The idea is that even relatively safe investments often offer stronger returns than even your top savings account rates. Because many of us feel like we have to have some lofty amount of disposable income before we can invest, micro-investing allows us to benefit from the markets without having to become experts in the process, all at relatively low risk to our savings.

There are other, less well-known options for relatively low-risk savings for normal folks. You’ve probably noticed we keep reference the Wealthry blogs. That’s because they’re an excellent place to begin exploring your options in plain, simple English a little bit at a time. You don’t have to spend hours doing research; take 30 minutes a few days a week and you’d be surprised how much you can learn.

When we talk about other types of savings, though, some of what we mean are things any of us can do starting today to reduce how much we’re spending unnecessarily, over and over each month. It may not seem like a huge savings to lower your cable bill by $15 a month, or cut your utilities by a few hundred dollars a year, but these sorts of savings are recurring and cumulative. The best way to make them happen isn’t to plan a single miracle day where you stay on the phone for 39 hours and negotiate every place with which you’ve ever interacted into submission. It’s to be regularly attentive to the possibilities and set aside an hour or two a week to make those small, but recurring changes. We can help you do that.

Of course, sometimes the biggest savings come during the biggest transactions. Buying a home, financing a vehicle, taking out a consolidation loan to pay off credit card debt – we can help you know what to watch out for and where to tweak these transactions as well. It’s not about being overly focused on money. The money itself isn’t really the endgame. But the reality of modern life is that money impacts almost everything in our worlds which does matter to us – the opportunities we’re able to provide for our children, the level of medical care we’re able to afford for ourselves and our partner, the places we’re able to go, the careers we’re able to choose, and even the age at which we’re able to retire.

Money isn’t the Emerald City, but it’s often the Yellow Brick Road. The more efficiently and effectively we can travel it, the sooner we’ll be able to secure our individual goals.

One of our anchor services here at Goalry is connecting individuals with reputable online financial services – for loans, investments, savings, refinancing, or any of your other personal or small business financial needs. We maintain a curated database of a wide variety of direct banking services and what they do best. That way, you don’t have to simply type in a few search terms and hope for the best – we help navigate it for you.

Like a realtor or talent agency, we separate the wheat from the chaff ahead of time to make your search more effective and help you reach your goals that much more efficiently. There’s nothing obligating you to go with our suggestions, of course, but years of feedback suggest we’re pretty good at matching people up successfully. (In terms of financial goals, that is – we make no promises regarding your romantic prospects.)

We’re taking things to the next level, however, with our next-generation apps and tools to make it easier for you to save. Easier for you to budget. Easier for you to prepare for tax season. Easier for you to manage your investments. Technology isn’t always great at making important decisions, but it can be amazing and managing huge amounts of information and pulling up what you need, when you need it, in the format you find useful, when you need it and wherever you happen to be. Knowledge is power, and there are few things more powerful than the ability to harness knowledge as easily as you clear the bars on your fitness tracker or check social media to see who you’re mad at today. Imagine all of those possibilities at your fingertips, as individual apps or working together in concert, to help you make the best decisions possible with the least amount of time or stress.

Keep watching, and in the meantime check out what’s already happening on Wealthry and across the Goalry family. When you’re ready, just let us know where you’d like to begin.