Retirement

Of all the things we’re supposed to think about and plan ahead for, retirement is one of the most challenging. There are so many factors we can’t fully anticipate. What will the economy look like years from now? What kind of health will we be in? What will our employment situation be leading up to retirement? Will Social Security still be around? Will we even still be around to, you know… retire? And if so, how long will we be drawing on our retirement?

No one likes to think about getting older, and most of us aren’t interested in pondering our own passing. At the same time, the great American tradition of “try not to think about it and maybe it will all work out” is probably not one of the best retirement plans. So where do we begin?

You may be familiar with the “Serenity Prayer” that seemed to be cross-stitched in every grandmother’s kitchen or bathroom back in the 1970s. It began, “God grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference…” As thankful as we may be to have moved past the 70s, that’s still pretty good advice. We plan for what we can plan for. Sometimes things won’t go exactly as we anticipate. More often than not, however, we’ll be glad we prepared as best we could.

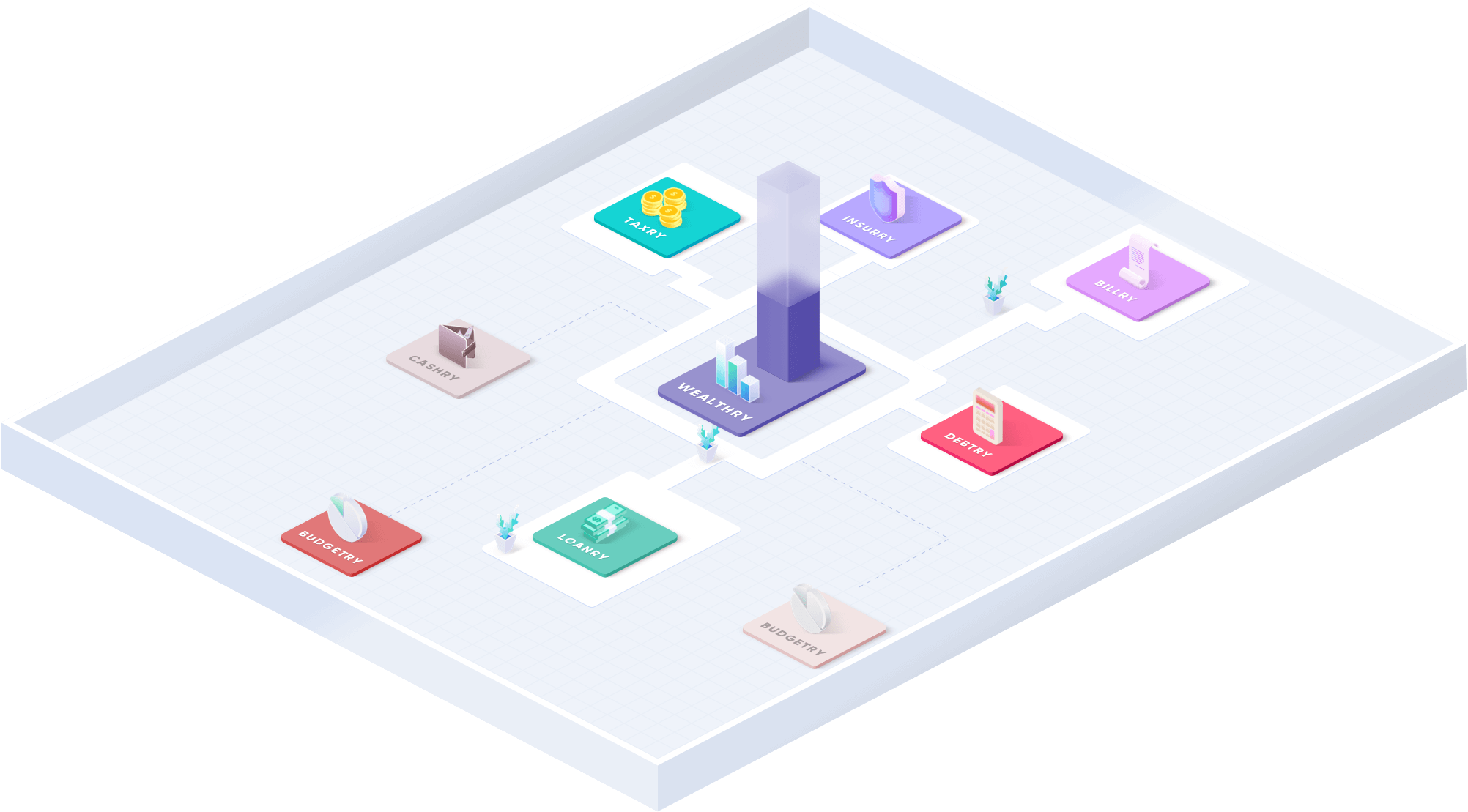

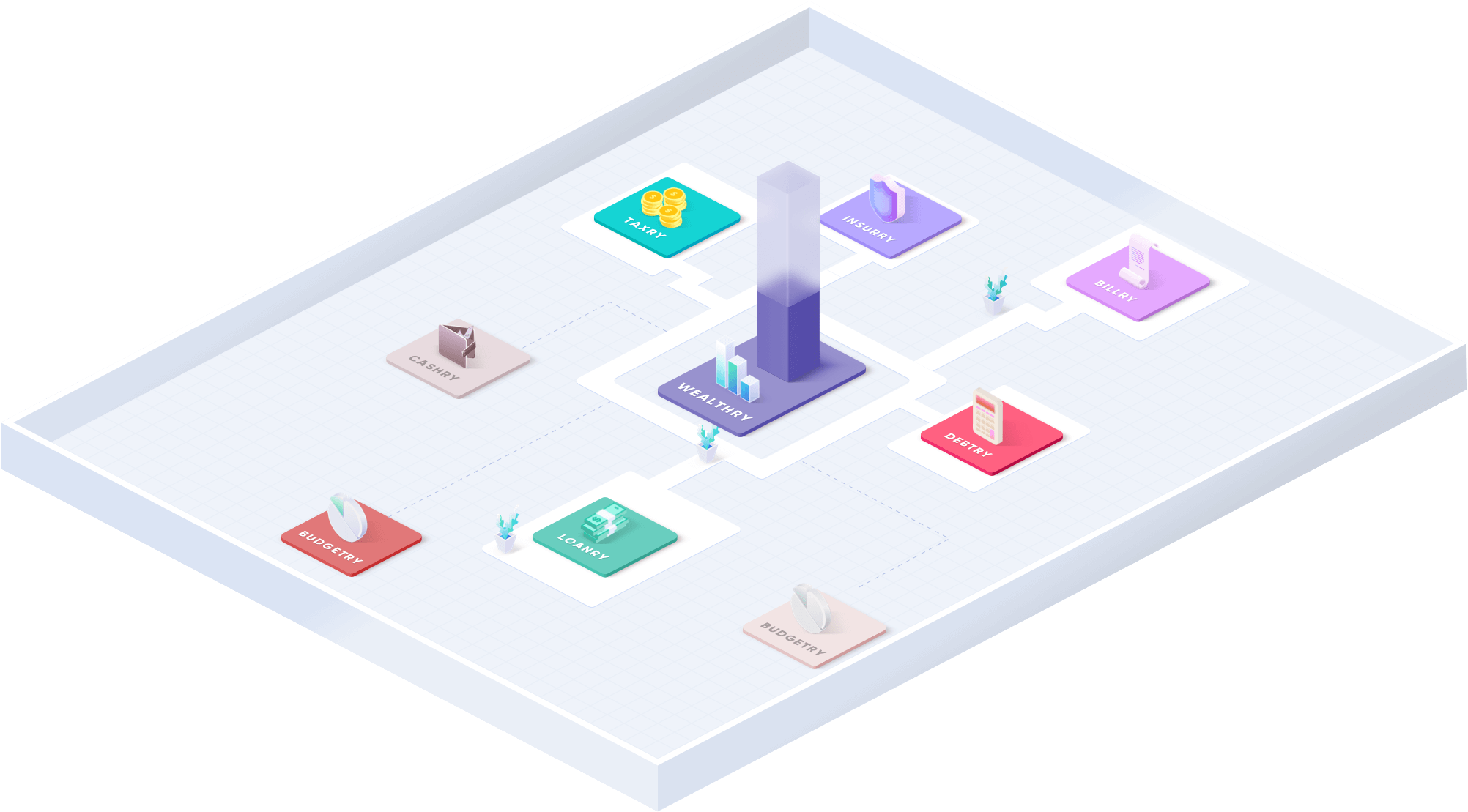

The blogs and videos at Wealthry, and across the Goalry family, are intentionally written in plain, simple English in order to make the world of finance accessible and digestible for almost anyone who’s interested. We also encourage you to seek out other reputable financial sites – the ones focused on education and insight, not the ones interrupting every few paragraphs to push unrelated links and programs on you.

There are plenty of places willing to help you plan for retirement, compare types of retirement accounts, explore the benefits of Roth IRA plans to 403(b) plans or balance your real estate investments with your mutual funds. Retirement plan companies must, of course, charge substantially for these services, and if you don’t feel like you’re on track to begin with and your disposable income is limited, you may be hesitant to go that route. We can help you compare retirement companies and make the best decision possible, or we can help you compare types of retirement accounts yourself. Sometimes the best plan for my retirement is for me to plan my retirement myself!

If that’s the route you’ve chosen – at least for now – there are several things we suggest to support you on this journey. The first is to make good use of the information already available. We live in weird times, but one of the undeniable positives of the 21st century is the vast amount of information available to almost anyone from any connected device, wherever they happen to be.

We’ve taken the collective innovation of a wide range of programs and applications already working and asked ourselves how to make them even easier to use, even more powerful and flexible, and how to allow them to work together as seamlessly as they do separately. It’s easier than ever to do your banking online, to do your shopping online, or even to keep up with work or friendships online. Why shouldn’t you be able to plan for and coordinate your retirement online?

No technology can replace your ability (and responsibility) to make the best decisions you can. Imagine how much easier those decisions could be, however, if categorizing your spending or analyzing your debt were as easy as checking social media or texting an emoji to a friend. Imagine the data-crunching power of 21st-century technology bringing you the information you want, when you need it, in whatever format you determine, on whatever device you choose. Imagine alerts whenever there’s a change to one of your accounts, or notifications whenever you hit specified savings or debt-reduction goals. Imagine a fitness tracker for your personal or small business finances – and you don’t even have to wear the embarrassing pants.

Knowing how much you’ll need in retirement savings starts with two things – analyzing your current financial situation and lifestyle and defining retirement goals.

Your current financial situation means how much you’re making, spending, saving, and investing right now. If you’re not using a meaningful personal or household budget, that’s an essential first step. Budgets aren’t about telling you how you can or can’t spend your money. An effective budget shows you how you’re spending your money so that you can make more informed decisions and better plans moving forward. Before we can begin to think realistically about a retirement budget, we need an accurate understanding of our current budget.

If you have excessive debt, that should be addressed early in the retirement planning process. While you shouldn’t wait until you’re completely debt-free to get serious about retirement, enough debt will offset many of the gains you might make from saving and investing. This is NOT the time to either ignore your debt or become so discouraged by it that it seems like there’s no point trying. It took time to get yourself into debt; it will take a little time to get out. The best time to start that process is now.

Let’s assume you have a workable budget from which you operate. We’ll also assume your debt is manageable at the moment so that you can begin thinking realistically about investing in the future. What kind of retirement budget am I likely to need?

The Realistic Retirement Calculator: 80% and 4%

Most experts suggest starting with the assumption you’ll need a retirement income of at least 80% of your pre-retirement income. For example, if you’re making an average of $90,000 per year in the decade before you retire, you’ll want to have around $72,000 per year available when you retire in order to live comfortably. Keep in mind these are starting places – if your plan is to travel extensively with your partner when you retire, that changes the equation considerably. On the other hand, if you intend to sell the family estate and move into the guest quarters at your daughter’s house to live out the rest of your days, you may not need quite that much.

So how do we plan on a specific income amount? How do we know how much we need to have saved or invested before retiring to reach that goal?

That’s the second starting point for the average retirement savings plan – it’s called the 4% rule. Take the calculated annual income you’ll need after you retire and divide it by 4%. That gives you a ballpark idea of how much you’ll want to have saved and invested for retirement. In the example above, the target is $72,000 per year. That figure divided by 4% is $1,800,000. Each year of retirement, you’ll then draw 4% of your total savings to live on. If everything else cooperates and current averages hold, this system can provide up to thirty years of relatively comfortable retirement.

What If My Retirement Isn’t Enough?

This is a good time to stop and take a breath. It sounds like a lot, to be sure. Keep in mind that these are just sample figures to help make sense of the math. Also remember that the primary purpose of everything we do here at Wealthry and across the Goalry family is to help you take more effective control of your personal and small business finances. People in circumstances very much like yours have reached some amazing goals, and you can, too. Add some of the re-imagined technological conveniences we’ll soon be unveiling and you’ll find that what seems impossible is often quite doable once you decide it’s important to you.

If you’re still concerned, you’re in good company. While different calculation methods produce different totals, the average retirement savings of Americans at all stages of life is far below what experts recommend. By most accounts, working adults in their 40s average only around $60,000 in retirement savings. The average retirement savings of those in their 70s is below $200,000. We can choose to be discouraged by this, or we can recognize that we’re not alone in our efforts. We can recognize that if we start now, we’re in better shape than many folks. Those same surveys show that for an alarming percentage of working Americans, their total average retirement savings is zero. Nothing at all.

Finally, know that numbers like 80% and 4% represent goals, not barriers. For many of you they are quite reachable, especially if you’re more than a decade or two away from retirement. There are numerous online versions of realistic retirement calculator. Play with a few and get comfortable with the numbers. They may not solve all of your problems, but the sooner we can get past panicking or trying not to think about it at all, the sooner we can begin honestly defining retirement goals and making a proper retirement savings plan.

Even if you don’t reach the suggested goals, the steps you take towards them now will make a huge difference down the road. Having access to half of what experts suggest for your average retirement savings still puts you ahead of most. Saving even a quarter of what’s encouraged is far more savings than you’d have if you didn’t try at all. You’ve probably heard the saying that “the journey of a thousand miles begins with a single step.” Well, the journey towards a few million dollars begins with a single deposit or investment.

Social Security can be difficult to accurately anticipate. Despite its name, if you’re more than a decade from retirement, you’ve probably wondered from time to time if it will even still exist by the time you qualify. Ideally, it’s not something you rely on in your calculations towards retirement. It can, however, provide a critical bump in helping you make the most of your twilight years.

The amount you’ll receive in Social Security each month after retiring is based on the 35 highest-earning years of your life. If you didn’t work for a full 35 years, the unemployed years count as zero income in calculating your payments. The total will be adjusted based on the age at which you retire. Currently, if you retire before the age of 66 or 67, your benefit will be reduced. The longer you delay retirement after reaching eligibility, the more your Social Security income will be. There are further possible adjustments based on your marital status and Medicare premiums.

There are a few pathways towards retirement which have proven far more common than the rest. That’s usually a good sign that they’re working for many people. Here are a few of the most popular.

A 401(k) is the most common retirement plan companies offer employees as part of their overall benefits packages. Some employers will contribute to employees’ 401(k) plans as well. You’ll be asked how much you’d like to have deducted from your check each month to go towards your 401(k). You’ll also usually have some control over the types of investments utilized by the plan – high risk (and higher potential rewards), medium risk (and moderate rewards), or low risk (with lower, but more reliable, rewards).

If you know you don’t have other investments and you’re not sure of your ability to save adequately on your own, consider stretching yourself here a bit. Give as much as you can reasonably afford towards your 401(k), starting as early as possible. Your 401(k) is a qualified retirement plan, meaning the income you invest directly into the plan isn’t taxed as it accumulates. It’s also deducted from your paycheck pre-tax, meaning when you contribute to a 401(k), you’re lowering your taxable income.

As with taxes or other withholdings, it’s often easier to adjust to the lowered take-home pay if you never see the money to begin with. If your employer bases their contributions on your own – matching what you invest, for example – the benefits multiply even more dramatically.

The 403(b) is a similar program for employees of government institutions, libraries, public schools or other tax-exempt organizations. While you should verify the specifics with your benefits department, the same basic strategy applies – the earlier you can invest and the more you can invest, the better off you’ll be down the road.

The 401(k) and 403(b) are fairly straightforward, relatively low-risk options, and two of the best retirement plans out there. The best way to save for retirement doesn’t have to be complicated. It’s often more about starting early and contributing consistently than taking big risks or unraveling complicated financial opportunities.

IRA stands for “Individual Retirement Account.” As the name suggests, IRAs are initiated by you, the individual, rather than your employer. You can set up a Traditional IRA through your local credit union or reputable online financial institutions and decide how much you’d like to contribute each pay period. In many cases, the money you contribute can be deducted on your tax return, and because it’s a qualified retirement plan, your earnings are not taxed until you withdraw them after you retire. IRAs come in several varieties, all of which are some of the best retirement plans available to almost anyone. As with 401(k) plans, the best way to save for retirement is to start now.

A Roth IRA is similar to a traditional IRA but your investment is taxed before deposited, just like the rest of your income. The benefits of Roth IRA plans come at retirement, when withdrawals are tax-free. A Rollover IRA allows you to “roll over” funds from another retirement plan in order to secure better interest rates or other future advantages.

It’s usually a good idea to have a retirement savings plan beyond your 401(k) or IRA. Or, if you don’t have a 401(k), IRA, or something similar, a committed retirement savings plan is absolutely essential. While it’s always wise to have some of your savings in a basic savings account for easy access, there are better ways to invest towards retirement as long as you leave an emergency fund of sorts in your basic savings account.

Take a little time to browse the Wealthry blogs to get a good overview of CDs, mutual funds, money market accounts, and what it actually means to invest in stocks or bonds. The earlier you are in your working life, the more seriously you’ll want to consider higher-risk investment options like stocks. The closer you are to retirement, the more important it is to preserve capital and hold on to what you have as long as possible.

It can seem a bit intimidating to consider these things if they’re not part of your world already. That’s where we can help almost immediately and without any major decisions or commitments on your part.

We know we can’t make everything about retirement planning or retirement savings easy, but it doesn’t have to be as difficult as it sometimes seems. More important, you don’t have to figure it all out alone. When you’re ready, let us know where you’d like to begin. And remember – the best retirement plans are the ones you don’t put off. The best retirement plans are the ones that start today.