Money Management

Personal money management has much in common with trying to eat right and exercise. We all agree we should do it. Most of us have a pretty good idea how it should probably work. Many of us have given it a pretty good go from time to time. And yet… well…

It’s just so hard to keep up with it all and there’s so much else going on and maybe other people can do it but we’re not sure we can and what’s the point anyway it never works so why worry about it? Fine – I’m a failure!

Except you’re not. You’re right about so much else going on. You’re right that sometimes you do your best and it doesn’t work. You’re also right that other people in very similar circumstances have been successful with personal money management. Maybe you haven’t… yet. May it hasn’t all come together… yet. Maybe you’ve been frustrated and discouraged… so far. But today is not yesterday. This week is not last week. And next year – lord willing – won’t be this year.

We can’t promise it will be easy, but it doesn’t have to be as complicated as we sometimes make it. And you don’t have to keep trying to figure it out all alone.

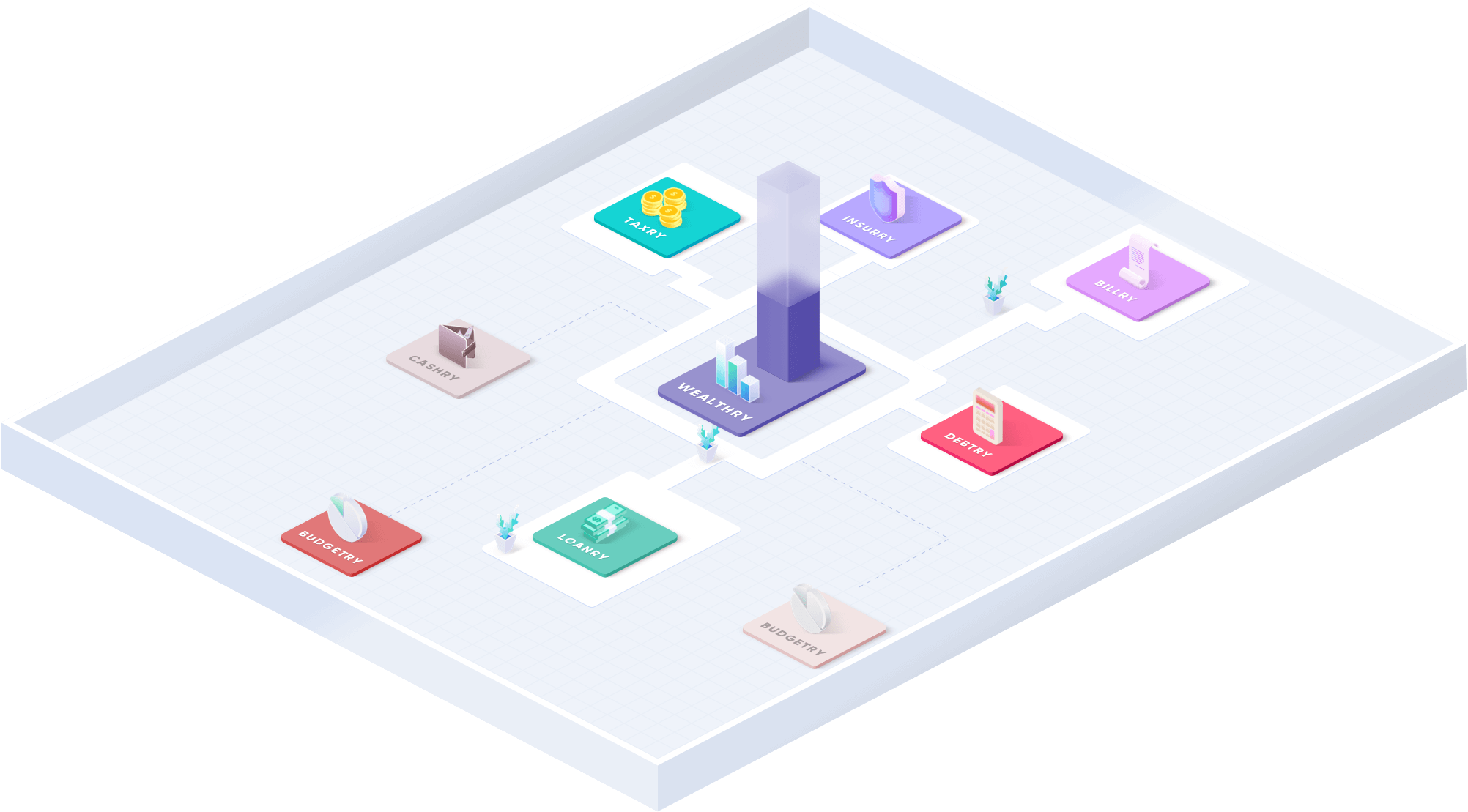

Yes, the Wealthry blogs have reviews and lists and connections to all of those things. We’re big fans of online financial management tools from all sorts of reputable organizations! We’re also fans of learning from the best elements of each of the available tools and finding ways to make them even more intuitive, flexible, and practical for the average user.

Take a moment to appreciate, however, the fact that these are things you can search for online in the first place. You can make important changes and move meaningfully forward in your personal money management from your couch, the break lounge at work, or standing in line at the grocery store. From anywhere, on any connected device, you can browse for financial management apps knowing full well you’ll have dozens of reputable options. Many of them you could download and begin using before the lady in front of you finishes arguing with the cashier about which size mac’n’cheese was actually on sale.

The whole concept is still a little miraculous, don’t you think?

Your parents didn’t have to wonder which expense tracker app to download because financial management apps weren’t a thing. If they had a money management spreadsheet, it was probably in a paper ledger with smudges and wrinkled pages and too many crossed out pages. You, in the meantime, can have your grocery store purchase categorized, deducted from your checking account, filed with your personal receipts, and the three items you picked up for your freelance gig already marked for retrieval when you do your taxes – all before the cashier wishes you a nice day.

Why are we making such an issue of a few clever apps and organizational tools? Because they exist, and they represent a larger truth of basic money management: maybe you couldn’t do it before, but you can now. Maybe you didn’t keep up with it before, but you will now. Maybe there didn’t seem to be any point before, but there is now. It’s not just the financial management apps. You have more access to practical information, advice, and encouragement in real time, from wherever you happen to be, than anyone outside the ultra-wealthy did only a few generations ago.

You have almost unlimited access to plain, simple English understanding of small business financing, stocks and bonds, different types of mortgages, how interest rates are computed, why online lending is so competitive, how to realistically get out of overwhelming credit card debt, how to get the best vehicle financing, and what options “normal” people have for preparing for retirement even if they should have started sooner. You can understand any of this without a degree in American fiscal systems and without having your own team of personal financial advisors. You have it because we live in an age of unprecedented access to information and options – starting with the Wealthry blogs and financial management videos. And they’re just the beginning.

That’s the how. Now let’s look at the why.

If you’re currently in credit card debt and living paycheck to paycheck, it’s a good time to up your money management game. There are affordable, intuitive, game-changing financial management tools available, and even better ones on the way. They won’t do it for you, but they’ll make it far more doable.

If you’re middle class and doing as well as can be expected given how expensive it is to raise kids and all the recent financial upheaval across the country, it’s a good time to refocus on the best way to manage money and take advantage of a decent money tracker app or online money management program. You’ve already figured out how much difference $20 here and $40 there can make in the big picture; let’s get a bit more serious about making those differences happen consistently and see what’s possible.

If you have a little money saved and a few retirement accounts (one through your employer and another of your own) and you’re a decade or so from retiring, this is a great time to consider ways to improve your personal money management. You figured out social media and use email just fine; imagine simplifying your savings, budgeting, and tax preparation with a few clicks or swipes each time you make a purchase or move money around. How much of a game changer could that be over time?

Whatever your age, profession, or financial circumstances, better money management can make a meaningful difference for your future. It could have a powerful impact on tomorrow. It may not seem like taking a few extra moments to track your spending or update an online money management spreadsheet can solve all of your problems – and it won’t. But “solving all of your problems” isn’t the goal. Preventing future problems and reducing the ones you currently face are big enough challenges. And those are things a decent money tracker app or easy budget app, utilized as part of an overall shift in how we manage our resources, can absolutely impact.

Use the best ones currently available. We’ll help you figure out what they are. Watch for something even better. When it comes, we’ll help you transition. What part of that sounds so very difficult?

If you’re currently in credit card debt and living paycheck to paycheck, it’s a good time to up your money management game. There are affordable, intuitive, game-changing financial management tools available, and even better ones on the way. They won’t do it for you, but they’ll make it far more doable.

If you’re middle class and doing as well as can be expected given how expensive it is to raise kids and all the recent financial upheaval across the country, it’s a good time to refocus on the best way to manage money and take advantage of a decent money tracker app or online money management program. You’ve already figured out how much difference $20 here and $40 there can make in the big picture; let’s get a bit more serious about making those differences happen consistently and see what’s possible.

If you have a little money saved and a few retirement accounts (one through your employer and another of your own) and you’re a decade or so from retiring, this is a great time to consider ways to improve your personal money management. You figured out social media and use email just fine; imagine simplifying your savings, budgeting, and tax preparation with a few clicks or swipes each time you make a purchase or move money around. How much of a game changer could that be over time?

Whatever your age, profession, or financial circumstances, better money management can make a meaningful difference for your future. It could have a powerful impact on tomorrow. It may not seem like taking a few extra moments to track your spending or update an online money management spreadsheet can solve all of your problems – and it won’t. But “solving all of your problems” isn’t the goal. Preventing future problems and reducing the ones you currently face are big enough challenges. And those are things a decent money tracker app or easy budget app, utilized as part of an overall shift in how we manage our resources, can absolutely impact.

Use the best ones currently available. We’ll help you figure out what they are. Watch for something even better. When it comes, we’ll help you transition. What part of that sounds so very difficult?

If you’re currently in credit card debt and living paycheck to paycheck, it’s a good time to up your money management game. There are affordable, intuitive, game-changing financial management tools available, and even better ones on the way. They won’t do it for you, but they’ll make it far more doable.

If you’re middle class and doing as well as can be expected given how expensive it is to raise kids and all the recent financial upheaval across the country, it’s a good time to refocus on the best way to manage money and take advantage of a decent money tracker app or online money management program. You’ve already figured out how much difference $20 here and $40 there can make in the big picture; let’s get a bit more serious about making those differences happen consistently and see what’s possible.

If you have a little money saved and a few retirement accounts (one through your employer and another of your own) and you’re a decade or so from retiring, this is a great time to consider ways to improve your personal money management. You figured out social media and use email just fine; imagine simplifying your savings, budgeting, and tax preparation with a few clicks or swipes each time you make a purchase or move money around. How much of a game changer could that be over time?

Whatever your age, profession, or financial circumstances, better money management can make a meaningful difference for your future. It could have a powerful impact on tomorrow. It may not seem like taking a few extra moments to track your spending or update an online money management spreadsheet can solve all of your problems – and it won’t. But “solving all of your problems” isn’t the goal. Preventing future problems and reducing the ones you currently face are big enough challenges. And those are things a decent money tracker app or easy budget app, utilized as part of an overall shift in how we manage our resources, can absolutely impact.

Use the best ones currently available. We’ll help you figure out what they are. Watch for something even better. When it comes, we’ll help you transition. What part of that sounds so very difficult?

But money management is more than the mechanics. It’s the goals. It’s the flexibility and terms to which you’ll have access the next time you want to buy a home or finance a vehicle. It’s the choices you’ll have when considering a career change or when your son or daughter is looking at colleges. It’s the confidence that comes from knowing you can pay for those prescriptions or cover those medical bills – not because you’re rich, but because you’re responsible. Not because you got lucky, but because you planned ahead.

Another wise voice once suggested that we’re all fallible. We all make plenty of mistakes. If we learned to control our tongues, however, we could probably control just about anything else about our lives and our choices. In other words, if we can learn to be responsible with our words, we can master just about anything. Money is like that. If we can learn to be responsible with the little choices we make each day in what we spend and how we save, we can do just about anything. Faithful in the small things… ready for the big things.

We can help you with making an effective budget. We’re experts at cutting little expenses using a household expense tracker in ways that add up to major savings over time. We have a staff of professionals who can explain investments and mortgage rates and credit scores, all in practical, real-world terms that help you make practical, real-world decisions. And, as you’ve probably picked up on, we’re determined to bring you the best personal finance app store available in the 21st century.

But it starts with you. We’ve got tools and knowledge and connections to offer, but only you have the “why.” What’s the best way to manage money? Start by thinking about what’s really important to you that’s not money. Then think about how much you could do for those priorities if you could reduce the burdens not having enough money can cause. Think about how much you could accomplish if you could start taking small steps towards taking more effective control of your finances by taking advantage of the available tools and information already here.

Imagine what’s possible. Because it is.

What is money management? Yes, it’s the re-imagined next generation best personal finance app we can offer (keep watching this site!) Yes, it’s the online expense manager you choose to use from Wealthry or one of the other reputable sites out there. Yes, it’s categorizing spending and comparing interest rates and predicting how much you’ll have saved by such-and-such date if you set aside this much each week or round off each purchase using this best money management app or that personal expense tracker app. The tools matter. Using them consistently matters. Reading up on the information and options available to you matters. We’re working very hard at the moment to make sure the next generation of financial management apps are powerful and flexible enough to adapt to whatever your circumstances and priorities might be while remaining intuitive and efficient so that taking more effective control of your personal money management is as easy as responding to that text from mom or pulling up the latest funny video.